EUR/USD intraday: under pressure.

Update on supports and resistances. ( 01/03/2012 07:09 )

Pivot: 1.3390.

Our Preference: SHORT positions @ 1.338 with targets @ 1.3315 & 1.329.

Alternative scenario: The upside penetration of 1.339 will call for a rebound towards 1.342 & 1.3485.

Comment: the pair is posting a rebound but stands below its new resistance.

Trend: ST Ltd Upside; MT Range

Key levels Comment

1.3485** Horizontal resistance

1.342** Horizontal resistance

1.339** Intrady pivot point

1.3345 Last

1.3315** Horizontal support

1.329** Horizontal support

1.3265** Horizontal support

Tips

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

NEWS:

The euro dipped against the U.S. dollar on Thursday, after Federal Reserve Chairman Ben Bernanke dampened expectations for fresh easing measures and after the European Central Bank launched its second liquidity operation.

EUR/USD hit 1.3307 during late Asian trade, the pair’s lowest since February 23; the pair subsequently consolidated at 1.3318, inching down 0.05%.

The pair was likely to find support at 1.3230, the low of February 23 and resistance at 13485, Wednesday’s high.

In testimony to Congress on Wednesday, Bernanke acknowledged the recent improvement in the labor market and said that higher oil prices could push up inflation. However, Bernanke also said the central bank was prepared to adjust the balance sheet “as appropriate” to support the economic recovery.

Meanwhile, the euro remained under pressure after the ECB allotted EUR529.5 billion in three-year loans to 800 lenders in its second long-term refinancing operation on Wednesday, as concerns over the long-term effectiveness of the liquidity boost weighed.

The euro was almost unchanged against the pound, with EUR/GBP inching up 0.01% to hit 0.8372.

Later in the day, the euro zone was to produce final data on manufacturing activity, followed by a preliminary estimate of consumer price inflation and an official report on the unemployment rate. European Union leaders were to hold the first day of a two day summit meeting in Brussels.

The U.S. was to release government data on unemployment claims, while the Institute for Supply Management was to produce a report on manufacturing activity. In addition, Ben Bernanke was due to testify for a second day before Congress.

Perkongsian ilmu forex trading, indicator forex, sistem forex, infomasi, berita ekonomi, urusniaga, matawang, komoditi...

Rabu, 29 Februari 2012

Analysis Crude Oil - 29 Feb 1008

Crude Oil (Mar 12) MT: aim @ 114.

Update on supports and resistances. ( 29/02/2012 10:08 )

Pivot: 89.50

Our Preference: Long above 89.5 with targets @ 114 & 122.5 in extension.

Alternative Scenario: Below 89.5 eye a drop towards 77.

Comment: even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

Trend: ST Ltd upside; MT Bullish, we have been bullish since 26 OCT 2011 (90.5).

Key levels Comment

126.5 Fib projection

122.5 Fib retracement (78.6%)

114 Swing high

105.83 Last

89.5 Pivot point

77 Horizontal support

68 Horizontal support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

NEWS:

Crude oil futures regained strength on Wednesday, bouncing off a four-day low as investors await the outcome of the second long-term refinancing operation from the European Central Bank later in the day, while continuing to monitor tensions between Iran and the West.

On the New York Mercantile Exchange, light sweet crude futures for delivery in April traded at USD107.11 a barrel during European morning trade, gaining 0.53%.

It earlier rose by as much as 0.6% to trade at a session high USD107.20 a barrel. Prices dropped nearly 2% on Tuesday, the biggest daily decline in almost five weeks, after U.S. durable goods orders plunged last month.

Prices rebounded as investors looked ahead to the launch of the ECB’s second three-year long-term refinancing operation, after a similar liquidity injection in December eased pressure on peripheral euro zone bond markets.

Market participants expect the liquidity operation to total nearly EUR500 billion, after banks borrowed EUR489 in the December operation.

Meanwhile, oil traders continued to monitor tensions between Iran and the West and a potential disruption to oil supplies from the region.

Growing tensions between Iran and Israel also remain in focus. There are fears that an escalation of hostilities between Israel and Iran could set off a conflict across the region and send oil prices skyrocketing.

Israel and the U.S. have previously stated that all options are on the table in ensuring the Islamic Republic does not acquire atomic weapons.

Iran produces about 3.5 million barrels of oil a day, making it the second largest oil producer in the Organization of Petroleum Exporting Countries, after Saudi Arabia.

Market participants were also looking forward to the U.S. Energy Information Administration’s closely-watched weekly report on U.S. stockpiles of crude and refined products to gauge the strength of oil demand in the world’s largest oil consumer.

The report was expected to show that U.S. crude oil stockpiles rose by 1.2 million barrels last week, while gasoline supplies were forecast to increase by 0.2 million barrels.

After markets closed Tuesday, the American Petroleum Institute, an industry group, said that U.S. crude inventories rose by 0.5 million barrels last week, below forecasts for a 1.1 million barrel buildup.

Crude oil prices traded on the NYMEX have gained nearly 8.5% in February and are up almost 10% since the start of 2012.

Elsewhere, on the ICE Futures Exchange, Brent oil futures for April delivery rose 0.9% to trade at USD122.64 a barrel, with the spread between the Brent and crude contracts standing at USD15.53.

Brent futures have rallied nearly 10% since the beginning of February, the biggest monthly gain since February of last year, as geopolitical and production issues in Iran, the North Sea, South Sudan, Syria and Yemen tightened supplies.

Update on supports and resistances. ( 29/02/2012 10:08 )

Pivot: 89.50

Our Preference: Long above 89.5 with targets @ 114 & 122.5 in extension.

Alternative Scenario: Below 89.5 eye a drop towards 77.

Comment: even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

Trend: ST Ltd upside; MT Bullish, we have been bullish since 26 OCT 2011 (90.5).

Key levels Comment

126.5 Fib projection

122.5 Fib retracement (78.6%)

114 Swing high

105.83 Last

89.5 Pivot point

77 Horizontal support

68 Horizontal support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

NEWS:

Crude oil futures regained strength on Wednesday, bouncing off a four-day low as investors await the outcome of the second long-term refinancing operation from the European Central Bank later in the day, while continuing to monitor tensions between Iran and the West.

On the New York Mercantile Exchange, light sweet crude futures for delivery in April traded at USD107.11 a barrel during European morning trade, gaining 0.53%.

It earlier rose by as much as 0.6% to trade at a session high USD107.20 a barrel. Prices dropped nearly 2% on Tuesday, the biggest daily decline in almost five weeks, after U.S. durable goods orders plunged last month.

Prices rebounded as investors looked ahead to the launch of the ECB’s second three-year long-term refinancing operation, after a similar liquidity injection in December eased pressure on peripheral euro zone bond markets.

Market participants expect the liquidity operation to total nearly EUR500 billion, after banks borrowed EUR489 in the December operation.

Meanwhile, oil traders continued to monitor tensions between Iran and the West and a potential disruption to oil supplies from the region.

Growing tensions between Iran and Israel also remain in focus. There are fears that an escalation of hostilities between Israel and Iran could set off a conflict across the region and send oil prices skyrocketing.

Israel and the U.S. have previously stated that all options are on the table in ensuring the Islamic Republic does not acquire atomic weapons.

Iran produces about 3.5 million barrels of oil a day, making it the second largest oil producer in the Organization of Petroleum Exporting Countries, after Saudi Arabia.

Market participants were also looking forward to the U.S. Energy Information Administration’s closely-watched weekly report on U.S. stockpiles of crude and refined products to gauge the strength of oil demand in the world’s largest oil consumer.

The report was expected to show that U.S. crude oil stockpiles rose by 1.2 million barrels last week, while gasoline supplies were forecast to increase by 0.2 million barrels.

After markets closed Tuesday, the American Petroleum Institute, an industry group, said that U.S. crude inventories rose by 0.5 million barrels last week, below forecasts for a 1.1 million barrel buildup.

Crude oil prices traded on the NYMEX have gained nearly 8.5% in February and are up almost 10% since the start of 2012.

Elsewhere, on the ICE Futures Exchange, Brent oil futures for April delivery rose 0.9% to trade at USD122.64 a barrel, with the spread between the Brent and crude contracts standing at USD15.53.

Brent futures have rallied nearly 10% since the beginning of February, the biggest monthly gain since February of last year, as geopolitical and production issues in Iran, the North Sea, South Sudan, Syria and Yemen tightened supplies.

Analysis Silver - 29 Feb 1003

Silver MT: look for 43.4.

Update on supports and resistances. ( 29/02/2012 10:03 )

Pivot: 26.00

Our Preference: Bullish above 26 with targets @ 40.7 & 43.4 in extension.

Alternative Scenario: Below 26 eye a drop towards 23.5 and 19.75 in ext.

Comment: the break above the channel resistance is a key signal for further medium term gains.

Trend: ST Bullish; MT Bullish, we have been bullish since 4 JAN 2012 (29.4).

Key levels Comment

50 Swing high

43.4 Horizontal resistance

40.7 Fib retracement (61.8%)

37 Last

26 Pivot point

23.5 Horizontal support

19.75 Horizontal support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

NEWS:

silver for May delivery eased down 0.25% to trade at USD37.11 a troy ounce, while copper for May delivery gained 0.55% to trade at USD3.943 a pound.

Silver prices surged nearly 4% on Tuesday to hit the highest level since mid-September, after breaking through a key resistance level close to USD35.73 a troy ounce.

Market participants said that the breach above that level signaled an upward momentum in prices and triggered fresh buy orders from large institutional investors and hedge funds.

Silver prices have rallied almost 34% since the beginning of the year, while monthly gains for February are set to top 11%.

Update on supports and resistances. ( 29/02/2012 10:03 )

Pivot: 26.00

Our Preference: Bullish above 26 with targets @ 40.7 & 43.4 in extension.

Alternative Scenario: Below 26 eye a drop towards 23.5 and 19.75 in ext.

Comment: the break above the channel resistance is a key signal for further medium term gains.

Trend: ST Bullish; MT Bullish, we have been bullish since 4 JAN 2012 (29.4).

Key levels Comment

50 Swing high

43.4 Horizontal resistance

40.7 Fib retracement (61.8%)

37 Last

26 Pivot point

23.5 Horizontal support

19.75 Horizontal support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

NEWS:

silver for May delivery eased down 0.25% to trade at USD37.11 a troy ounce, while copper for May delivery gained 0.55% to trade at USD3.943 a pound.

Silver prices surged nearly 4% on Tuesday to hit the highest level since mid-September, after breaking through a key resistance level close to USD35.73 a troy ounce.

Market participants said that the breach above that level signaled an upward momentum in prices and triggered fresh buy orders from large institutional investors and hedge funds.

Silver prices have rallied almost 34% since the beginning of the year, while monthly gains for February are set to top 11%.

Analysis Gold - 29 Feb 0957

Gold MT: expect 1913.

Update on supports and resistances. ( 29/02/2012 09:57 )

Pivot: 1530.

Our preference: bullish above 1530 with 1800 & 1913 in sight.

Alternative scenario: A downside breakout of 1530 would open the way towards 1415.

Comment: the rising 50D simple moving average is turning up.

Trend: ST Bullish; MT Bullish, we have been bullish since 17 FEB 2010 (1114).

Key levels Comment

2000 Round number

1913 Swing high

1800 Horizontal resistance

1754

1530 Pivot point

1415 Horizontal support

1315 Horizontal support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

NEWS:

Gold futures held steady on Wednesday, pausing after the previous day’s sharp gain, as investors waited for a second liquidity injection from the European Central Bank later in the day before opening fresh positions.

On the Comex division of the New York Mercantile Exchange, gold futures for April delivery traded at USD1,788.05 a troy ounce during early European morning trade, easing up 0.1%.

It earlier rose by as much as 0.27% to trade at USD1,791.95 a troy ounce, the highest since November 14.

Futures were likely to find support at USD1,767.25 a troy ounce, Tuesday’s low and resistance at USD1,796.45, the high from November 14.

Investors looked ahead to the launch of the ECB’s second three-year long-term refinancing operation, after a similar liquidity injection in December eased pressure on peripheral euro zone bond markets.

Market participants expect the liquidity operation to total nearly EUR500 billion, after banks borrowed EUR489 in the December operation.

Gold can benefit from such an environment of easy money because of expectations that ample liquidity would put a damper on the value of paper currencies and boost inflation.

Gold prices have rallied nearly 14% since the beginning of 2012, boosted by growing expectations for further monetary easing measures from global central banks.

French-based financial service provider Societe Generale said in a report last week that it expected gold prices to “challenge” USD2,200 an ounce by the end of 2012.

“Global liquidity, negative real interest rates and persistent fears over fiat currencies as a whole will boost investment at all levels,” the bank said. “Even when the sovereign debt issues have been resolved in Europe, inflation will by then be an important issue.”

Further improving sentiment on the precious metal, Iran’s state-run news agency IRNA said Tuesday that the Persian Gulf country will take payment for oil from its trading partners in gold instead of dollars, in response to the financial embargoes imposed on the country.

Elsewhere on the Comex, silver for May delivery eased down 0.25% to trade at USD37.11 a troy ounce, while copper for May delivery gained 0.55% to trade at USD3.943 a pound.

Silver prices surged nearly 4% on Tuesday to hit the highest level since mid-September, after breaking through a key resistance level close to USD35.73 a troy ounce.

Market participants said that the breach above that level signaled an upward momentum in prices and triggered fresh buy orders from large institutional investors and hedge funds.

Update on supports and resistances. ( 29/02/2012 09:57 )

Pivot: 1530.

Our preference: bullish above 1530 with 1800 & 1913 in sight.

Alternative scenario: A downside breakout of 1530 would open the way towards 1415.

Comment: the rising 50D simple moving average is turning up.

Trend: ST Bullish; MT Bullish, we have been bullish since 17 FEB 2010 (1114).

Key levels Comment

2000 Round number

1913 Swing high

1800 Horizontal resistance

1754

1530 Pivot point

1415 Horizontal support

1315 Horizontal support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

NEWS:

Gold futures held steady on Wednesday, pausing after the previous day’s sharp gain, as investors waited for a second liquidity injection from the European Central Bank later in the day before opening fresh positions.

On the Comex division of the New York Mercantile Exchange, gold futures for April delivery traded at USD1,788.05 a troy ounce during early European morning trade, easing up 0.1%.

It earlier rose by as much as 0.27% to trade at USD1,791.95 a troy ounce, the highest since November 14.

Futures were likely to find support at USD1,767.25 a troy ounce, Tuesday’s low and resistance at USD1,796.45, the high from November 14.

Investors looked ahead to the launch of the ECB’s second three-year long-term refinancing operation, after a similar liquidity injection in December eased pressure on peripheral euro zone bond markets.

Market participants expect the liquidity operation to total nearly EUR500 billion, after banks borrowed EUR489 in the December operation.

Gold can benefit from such an environment of easy money because of expectations that ample liquidity would put a damper on the value of paper currencies and boost inflation.

Gold prices have rallied nearly 14% since the beginning of 2012, boosted by growing expectations for further monetary easing measures from global central banks.

French-based financial service provider Societe Generale said in a report last week that it expected gold prices to “challenge” USD2,200 an ounce by the end of 2012.

“Global liquidity, negative real interest rates and persistent fears over fiat currencies as a whole will boost investment at all levels,” the bank said. “Even when the sovereign debt issues have been resolved in Europe, inflation will by then be an important issue.”

Further improving sentiment on the precious metal, Iran’s state-run news agency IRNA said Tuesday that the Persian Gulf country will take payment for oil from its trading partners in gold instead of dollars, in response to the financial embargoes imposed on the country.

Elsewhere on the Comex, silver for May delivery eased down 0.25% to trade at USD37.11 a troy ounce, while copper for May delivery gained 0.55% to trade at USD3.943 a pound.

Silver prices surged nearly 4% on Tuesday to hit the highest level since mid-September, after breaking through a key resistance level close to USD35.73 a troy ounce.

Market participants said that the breach above that level signaled an upward momentum in prices and triggered fresh buy orders from large institutional investors and hedge funds.

Analysis EUR/USD - 29 Feb 0706

EUR/USD intraday: further advance.

Update on supports and resistances. ( 29/02/2012 07:06 )

Pivot: 1.3385.

Our Preference: LONG positions @ 1.3395 with 1.3485 & 1.353 as next targets.

Alternative scenario: The downside breakout of 1.3385 will open the way to 1.334 & 1.3295.

Comment: the pair remains on the upside and is challenging its previous high.

Trend: ST Ltd Upside; MT Range

Key levels Comment

1.355** Horizontal resistance

1.353** Horizontal resistance

1.3485** Horizontal resistance

1.3467 Last

1.3385** Intrady pivot point

1.334** Horizontal support

1.3295** Horizontal support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

NEWS:

The euro edged higher against the U.S. dollar on Wednesday, as investors awaited the outcome of the European Central Bank's second long-term refinancing operation later in the day.

EUR/USD hit 1.3485 during late Asian trade, the pair’s highest since February 24; the pair subsequently consolidated at 1.3476, gaining 0.13%.

The pair was likely to find support at 1.3356, last Friday’s low and resistance at 1.3485, the high of February 24 and a 12-week high.

In December, the EBC issued EUR489 billion in three-year loans to more than 500 banks, averting a liquidity shortage in the euro zone’s banking system and easing pressure on the region’s bond markets.

The euro came under pressure on Tuesday, after Ireland’s prime minister said the country will hold a referendum on the European Union's new fiscal treaty, which proposes harsh new budgetary discipline on each euro zone state, including near-zero public deficits.

The euro dipped against the pound but edged higher against the yen, with EUR/GBP slipping 0.06% to hit 0.8458 and EUR/JPY inching up 0.10% to hit 108.38.

Later in the day, Finland’s parliament was to vote on Greece’s bailout, while the U.S. was to release a preliminary report on fourth-quarter gross domestic product.

In addition, Federal Reserve Chairman Ben Bernanke was due to testify on the semi-annual monetary policy report before the House Financial Services Committee in Washington.

Update on supports and resistances. ( 29/02/2012 07:06 )

Pivot: 1.3385.

Our Preference: LONG positions @ 1.3395 with 1.3485 & 1.353 as next targets.

Alternative scenario: The downside breakout of 1.3385 will open the way to 1.334 & 1.3295.

Comment: the pair remains on the upside and is challenging its previous high.

Trend: ST Ltd Upside; MT Range

Key levels Comment

1.355** Horizontal resistance

1.353** Horizontal resistance

1.3485** Horizontal resistance

1.3467 Last

1.3385** Intrady pivot point

1.334** Horizontal support

1.3295** Horizontal support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

NEWS:

The euro edged higher against the U.S. dollar on Wednesday, as investors awaited the outcome of the European Central Bank's second long-term refinancing operation later in the day.

EUR/USD hit 1.3485 during late Asian trade, the pair’s highest since February 24; the pair subsequently consolidated at 1.3476, gaining 0.13%.

The pair was likely to find support at 1.3356, last Friday’s low and resistance at 1.3485, the high of February 24 and a 12-week high.

In December, the EBC issued EUR489 billion in three-year loans to more than 500 banks, averting a liquidity shortage in the euro zone’s banking system and easing pressure on the region’s bond markets.

The euro came under pressure on Tuesday, after Ireland’s prime minister said the country will hold a referendum on the European Union's new fiscal treaty, which proposes harsh new budgetary discipline on each euro zone state, including near-zero public deficits.

The euro dipped against the pound but edged higher against the yen, with EUR/GBP slipping 0.06% to hit 0.8458 and EUR/JPY inching up 0.10% to hit 108.38.

Later in the day, Finland’s parliament was to vote on Greece’s bailout, while the U.S. was to release a preliminary report on fourth-quarter gross domestic product.

In addition, Federal Reserve Chairman Ben Bernanke was due to testify on the semi-annual monetary policy report before the House Financial Services Committee in Washington.

Selasa, 28 Februari 2012

Analysis Crude Oil - 28 Feb 1133

Crude Oil (Apr 12) intraday: the downside prevails.

Update on supports and resistances. ( 28/02/2012 11:33 )

Pivot: 109.35

Our Preference: SHORT positions below 109.35 with 106.75 & 105.8 as next targets.

Alternative scenario: The upside breakout of 109.35 will open the way to 110.3 & 110.9.

Comment: as long as 109.35 is resistance, look for choppy price action with a bearish bias.

Trend: ST Bullish; MT Ltd upside

Key levels Comment

110.9** Fib projection

110.3** Fib projection

109.35** Intraday pivot point

108.37 Last

106.75** Intraday support

105.8** Intraday support

104.85** Intraday support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Update on supports and resistances. ( 28/02/2012 11:33 )

Pivot: 109.35

Our Preference: SHORT positions below 109.35 with 106.75 & 105.8 as next targets.

Alternative scenario: The upside breakout of 109.35 will open the way to 110.3 & 110.9.

Comment: as long as 109.35 is resistance, look for choppy price action with a bearish bias.

Trend: ST Bullish; MT Ltd upside

Key levels Comment

110.9** Fib projection

110.3** Fib projection

109.35** Intraday pivot point

108.37 Last

106.75** Intraday support

105.8** Intraday support

104.85** Intraday support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Analysis Gold - 287 Feb 1132

GOLD (Spot) intraday: further advance.

Update on supports and resistances. ( 28/02/2012 11:32 )

Pivot: 1760.00

Our Preference: LONG positions above 1760 with 1785 & 1790 in sight.

Alternative scenario: The downside penetration of 1760 will call for 1750 & 1736.

Comment: a bullish flag is taking place and calls for further rise.

Trend: ST Bullish; MT Bullish

Key levels Comment

1800*** Intraday resistance

1790* Intraday resistance

1785** Intraday resistance

1774.31 Last

1760*** Intraday pivot point

1750** Intraday support

1736** Intraday support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Update on supports and resistances. ( 28/02/2012 11:32 )

Pivot: 1760.00

Our Preference: LONG positions above 1760 with 1785 & 1790 in sight.

Alternative scenario: The downside penetration of 1760 will call for 1750 & 1736.

Comment: a bullish flag is taking place and calls for further rise.

Trend: ST Bullish; MT Bullish

Key levels Comment

1800*** Intraday resistance

1790* Intraday resistance

1785** Intraday resistance

1774.31 Last

1760*** Intraday pivot point

1750** Intraday support

1736** Intraday support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Analysis EUR/USD - 28 Feb 1123

EUR/USD intraday: further advance.

Update on supports and resistances. ( 28/02/2012 11:23 )

Pivot: 1.3375

Our preference: Long positions above 1.3375 with targets @ 1.3485 & 1.353 in extension.

Alternative scenario: Below 1.3375 look for further downside with 1.334 & 1.3295 as targets.

Comment: the pair remains on the upside and is approaching its previous high as the RSI is well directed.

Key levels

1.355

1.353

1.3485

1.34396 last

1.3375

1.334

1.3295

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Update on supports and resistances. ( 28/02/2012 11:23 )

Pivot: 1.3375

Our preference: Long positions above 1.3375 with targets @ 1.3485 & 1.353 in extension.

Alternative scenario: Below 1.3375 look for further downside with 1.334 & 1.3295 as targets.

Comment: the pair remains on the upside and is approaching its previous high as the RSI is well directed.

Key levels

1.355

1.353

1.3485

1.34396 last

1.3375

1.334

1.3295

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Isnin, 27 Februari 2012

Analysis Gold - 27 Feb 1156

GOLD (Spot) intraday: the downside prevails.

Update on supports and resistances.

Pivot: 1775.00

Our Preference: SHORT positions below 1775 with targets @ 1760 & 1750.

Alternative scenario: The upside penetration of 1775 will call for 1790 & 1800.

Comment: as long as 1775 is resistance, likely decline to 1760.

Trend: ST Bullish; MT Bullish

Key levels Comment

1800*** Intraday resistance

1790* Intraday resistance

1775** Intraday pivot point

1763.9 Last

1760*** Intraday support

1750** Intraday support

1736** Intraday support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Update on supports and resistances.

Pivot: 1775.00

Our Preference: SHORT positions below 1775 with targets @ 1760 & 1750.

Alternative scenario: The upside penetration of 1775 will call for 1790 & 1800.

Comment: as long as 1775 is resistance, likely decline to 1760.

Trend: ST Bullish; MT Bullish

Key levels Comment

1800*** Intraday resistance

1790* Intraday resistance

1775** Intraday pivot point

1763.9 Last

1760*** Intraday support

1750** Intraday support

1736** Intraday support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Analysis Crude Oil - 27 Feb 1149

Crude Oil (Apr 12) intraday: the downside prevails.

Update on supports and resistances.

Pivot: 109.35

Our Preference: SHORT positions below 109.35 with 107.9 & 106.75 as next targets.

Alternative scenario: The upside penetration of 109.35 will call for 110.3 & 110.9.

Comment: the RSI is bearish and calls for further downside.

Trend: ST Bullish; MT Ltd upside

Key levels Comment

110.9** Fib projection

110.3** Fib projection

109.35** Intraday pivot point

108.35 Last

107.9** Intraday suPport

106.75** Intraday support

105.8** Intraday support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Update on supports and resistances.

Pivot: 109.35

Our Preference: SHORT positions below 109.35 with 107.9 & 106.75 as next targets.

Alternative scenario: The upside penetration of 109.35 will call for 110.3 & 110.9.

Comment: the RSI is bearish and calls for further downside.

Trend: ST Bullish; MT Ltd upside

Key levels Comment

110.9** Fib projection

110.3** Fib projection

109.35** Intraday pivot point

108.35 Last

107.9** Intraday suPport

106.75** Intraday support

105.8** Intraday support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Analysis EUR/USD - 27 Feb 1131

EUR/USD intraday: turning down.

Update on supports and resistances.

Pivot: 1.3455

Our preference: Short positions below 1.3455 with targets @ 1.3385 & 1.334 in extension.

Alternative scenario: Above 1.3455 look for further upside with 1.3485 & 1.353 as targets.

Comment: the pair is breaking below its support and should face further weakness.

Key levels

1.353

1.3485

1.3455

1.34105 last

1.3385

1.334

1.3295

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Update on supports and resistances.

Pivot: 1.3455

Our preference: Short positions below 1.3455 with targets @ 1.3385 & 1.334 in extension.

Alternative scenario: Above 1.3455 look for further upside with 1.3485 & 1.353 as targets.

Comment: the pair is breaking below its support and should face further weakness.

Key levels

1.353

1.3485

1.3455

1.34105 last

1.3385

1.334

1.3295

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Ahad, 26 Februari 2012

Analysis Silver - 27 Feb 0732

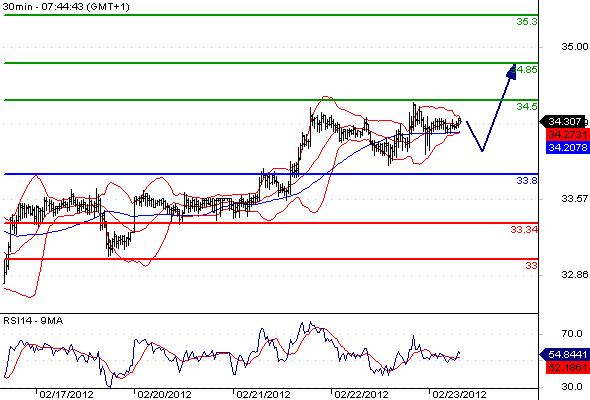

SILVER (Spot) intraday: rebound.

Pivot: 35.15

Our Preference: LONG positions above 35.15 with 35.7 & 36.25 in sight.

Alternative scenario: The downside penetration of 35.15 will call for 34.45 & 33.85.

Comment: intraday support around 35.15

Trend: ST Bullish; MT Range

Key levels Comment

36.8**

36.25**

35.7***

35.455 Last

35.15**

34.45***

33.85**

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Pivot: 35.15

Our Preference: LONG positions above 35.15 with 35.7 & 36.25 in sight.

Alternative scenario: The downside penetration of 35.15 will call for 34.45 & 33.85.

Comment: intraday support around 35.15

Trend: ST Bullish; MT Range

Key levels Comment

36.8**

36.25**

35.7***

35.455 Last

35.15**

34.45***

33.85**

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Analysis EUR/USD - 27 Feb 0723

EUR/USD intraday: further advance.

Update on supports and resistances. ( 27/02/2012 07:23 )

Pivot: 1.3400.

Our Preference: LONG positions @ 1.341 with 1.3485 & 1.353 in sight.

Alternative scenario: The downside penetration of 1.34 will call for a slide towards 1.334 & 1.329.

Comment: the pair remains on the upside.

Trend: ST Ltd Upside; MT Range

Key levels Comment

1.3565** Horizontal resistance

1.353** Horizontal resistance

1.3485** Intraday resistance

1.3441 Last

1.34** Intrady pivot point

1.334** Horizontal support

1.329** Horizontal support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Update on supports and resistances. ( 27/02/2012 07:23 )

Pivot: 1.3400.

Our Preference: LONG positions @ 1.341 with 1.3485 & 1.353 in sight.

Alternative scenario: The downside penetration of 1.34 will call for a slide towards 1.334 & 1.329.

Comment: the pair remains on the upside.

Trend: ST Ltd Upside; MT Range

Key levels Comment

1.3565** Horizontal resistance

1.353** Horizontal resistance

1.3485** Intraday resistance

1.3441 Last

1.34** Intrady pivot point

1.334** Horizontal support

1.329** Horizontal support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Analysis Gold - 27 Feb 0731

GOLD (Spot) intraday: the bias remains bullish.

Update on supports and resistances. ( 27/02/2012 07:31 )

Pivot: 1770.00

Our Preference: LONG positions above 1770 with 1782 & 1790 in sight.

Alternative scenario: The downside penetration of 1770 will call for a slide towards 1760 & 1750.

Comment: intraday support around 1770

Trend: ST Bullish; MT Bullish

Key levels Comment

1800*** Intraday resistance

1790* Intraday resistance

1782** Intraday resistance

1774 Last

1770** Intraday pivot point

1760** Intraday support

1750** Intraday support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Update on supports and resistances. ( 27/02/2012 07:31 )

Pivot: 1770.00

Our Preference: LONG positions above 1770 with 1782 & 1790 in sight.

Alternative scenario: The downside penetration of 1770 will call for a slide towards 1760 & 1750.

Comment: intraday support around 1770

Trend: ST Bullish; MT Bullish

Key levels Comment

1800*** Intraday resistance

1790* Intraday resistance

1782** Intraday resistance

1774 Last

1770** Intraday pivot point

1760** Intraday support

1750** Intraday support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Analysis Crude Oil - 27 Feb 0730

Crude Oil (Apr 12) intraday: the bias remains bullish.

Update on supports and resistances. ( 27/02/2012 07:30 )

Pivot: 108.50

Our Preference: LONG positions above 108.5 with 110.3 & 110.9 as next targets.

Alternative scenario: The downside penetration of 108.5 will call for 107.9 & 106.75.

Comment: the immediate trend remains up and the momentum is strong.

Trend: ST Bullish; MT Ltd upside

Key levels Comment

111.55** Fib projection

110.9** Fib projection

110.3** Fib projection

109.38 Last

108.5** Intraday pivot point

107.9** Intraday support

106.75** Intraday support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Update on supports and resistances. ( 27/02/2012 07:30 )

Pivot: 108.50

Our Preference: LONG positions above 108.5 with 110.3 & 110.9 as next targets.

Alternative scenario: The downside penetration of 108.5 will call for 107.9 & 106.75.

Comment: the immediate trend remains up and the momentum is strong.

Trend: ST Bullish; MT Ltd upside

Key levels Comment

111.55** Fib projection

110.9** Fib projection

110.3** Fib projection

109.38 Last

108.5** Intraday pivot point

107.9** Intraday support

106.75** Intraday support

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Analysis EUR/USD - 27 Feb 0053

EUR/USD intraday: further advance.

Update on supports and resistances. ( 27/02/2012 00:53 )

Pivot: 1.34

Our preference: Long positions above 1.34 with targets @ 1.353 & 1.3565 in extension.

Alternative scenario: Below 1.34 look for further downside with 1.334 & 1.329 as targets.

Comment: the RSI is above its neutrality area at 50%.

Key levels

1.36

1.3565

1.353

1.3468 last

1.34

1.334

1.3

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Update on supports and resistances. ( 27/02/2012 00:53 )

Pivot: 1.34

Our preference: Long positions above 1.34 with targets @ 1.353 & 1.3565 in extension.

Alternative scenario: Below 1.34 look for further downside with 1.334 & 1.329 as targets.

Comment: the RSI is above its neutrality area at 50%.

Key levels

1.36

1.3565

1.353

1.3468 last

1.34

1.334

1.3

TIPS:

Never risk more than 2-3% of the total trading forex account One important difference between a successful and an unsuccessful forex trader in forex Market is that the first is able to survive under unfavorable conditions on the forex market, while an unsuccessful forex trader will blow up his account after 5-10 unprofitable trades in the row.

Even with the same trading system 2 forex traders can get opposite results in the long run. The difference will be again in money management approach. To introduce you to money management, let's get one fact: losing 50% of total account requires making 100% return from the rest of money just to restore the original balance.

Jumaat, 24 Februari 2012

U.S. dollar lower on strong euro zone numbers, ECB support

The U.S. dollar traded lower against its major counterparts Friday, as stronger than expected German business confidence figures and European Central Bank support fuelled euro zone confidence.

During U.S. morning trade, the dollar was lower against the euro, with EUR/USD rising 0.28% to hit 1.3411.

The ECB may be tapped next week for EUR470 billion in three year funds for distribution on February 29. This is nearly the same amount that was provided in December, according to a Bloomberg survey.

This infusion of cash is expected to prolong the rally in the bond markets and will be used primarily to support the Italian and Spanish bond markets.

Euro zone inflation is in check and no floor exists under the 1% interest rate, ECB council member Erkki Liikanen told CNBC, calming fears of upside risk in the region.

Yesterday, the euro found strength when German research institute Ifo said its Business Climate Index rose to109.6 in February from a reading of 108.3 the previous month, surpassing expectations for an increase to 108.8, increasing hopes that the euro zone’s largest economy is on the road to recovery.

The greenback was also lower against the pound, with GBP/USD adding 0.48% to hit 1.5820.

The pound found support after the Confederation of British Industry reported that U.K. factory orders rebounded to hit a six-month high in February, rising by 13 points to minus 3.0, from a reading of minus 16 in January.

The greenback was higher against yen but lower against the Swiss franc, with USD/JPY gaining 0.65% to hit 80.53 and USD/CHF giving back 0.31% to hit 0.8988.

Japan's Prime Minister Yoshihiko Noda said earlier that he wants to have one-on-one talks with the Bank of Japan governor more frequently and to boost cooperation with the central bank.

The comments came after the BoJ’s decision last week to increase the size of its asset-purchase program to JPY30 trillion, sending the yen broadly lower.

In addition, the greenback was higher against its Canadian, Australian and New Zealand counterparts, with USD/CAD retreating 0.20% to hit 0.9993, AUD/USD falling 0.06% to hit 1.0711 and NZD/USD slipping 0.01% to hit 0.8364.

The dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, was down 0.12% to hit 78.58.

In the U.S., a report by the Department of Labor showed that the number of individuals filing for initial jobless benefits in the week ending February 18 held steady at 351,000, missing expectations for an increase of 3,000 to 354,000.

Jobless claims have remained below 400,000, a level historically associated with an improving labor market, in 15 of the past 17 weeks.

During U.S. morning trade, the dollar was lower against the euro, with EUR/USD rising 0.28% to hit 1.3411.

The ECB may be tapped next week for EUR470 billion in three year funds for distribution on February 29. This is nearly the same amount that was provided in December, according to a Bloomberg survey.

This infusion of cash is expected to prolong the rally in the bond markets and will be used primarily to support the Italian and Spanish bond markets.

Euro zone inflation is in check and no floor exists under the 1% interest rate, ECB council member Erkki Liikanen told CNBC, calming fears of upside risk in the region.

Yesterday, the euro found strength when German research institute Ifo said its Business Climate Index rose to109.6 in February from a reading of 108.3 the previous month, surpassing expectations for an increase to 108.8, increasing hopes that the euro zone’s largest economy is on the road to recovery.

The greenback was also lower against the pound, with GBP/USD adding 0.48% to hit 1.5820.

The pound found support after the Confederation of British Industry reported that U.K. factory orders rebounded to hit a six-month high in February, rising by 13 points to minus 3.0, from a reading of minus 16 in January.

The greenback was higher against yen but lower against the Swiss franc, with USD/JPY gaining 0.65% to hit 80.53 and USD/CHF giving back 0.31% to hit 0.8988.

Japan's Prime Minister Yoshihiko Noda said earlier that he wants to have one-on-one talks with the Bank of Japan governor more frequently and to boost cooperation with the central bank.

The comments came after the BoJ’s decision last week to increase the size of its asset-purchase program to JPY30 trillion, sending the yen broadly lower.

In addition, the greenback was higher against its Canadian, Australian and New Zealand counterparts, with USD/CAD retreating 0.20% to hit 0.9993, AUD/USD falling 0.06% to hit 1.0711 and NZD/USD slipping 0.01% to hit 0.8364.

The dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, was down 0.12% to hit 78.58.

In the U.S., a report by the Department of Labor showed that the number of individuals filing for initial jobless benefits in the week ending February 18 held steady at 351,000, missing expectations for an increase of 3,000 to 354,000.

Jobless claims have remained below 400,000, a level historically associated with an improving labor market, in 15 of the past 17 weeks.

Comex Gold Weaker On Corrective, Profit-Taking Pullback

Comex April gold futures prices are trading modestly lower in early U.S. dealings Friday. The market is seeing some profit taking and a downside technical correction following recent solid gains that pushed the yellow metal to a three-month high this week. Losses in gold are being limited by the key “outside markets” being in a bullish daily posture for the precious metals Friday, as the U.S. dollar index is lower and crude oil prices are firmer. April gold last traded down $8.10 at $1,778.20 an ounce. Spot gold was last quoted down $4.50 an ounce at $1,776.25. March Comex silver last traded down $0.286 at $35.27 an ounce.

The precious metals markets have had a very good week and profit-taking pullbacks heading into the weekend are not surprising, nor are they unhealthy from a technical perspective, given the recent solid price gains.

Gold and silver have seen stronger demand this week from the present stare-down between allies Israel and the U.S, and Iran. Increasing focus in the media on the potential for Israel or U.S. military action against Iran has prompted increase investor anxiety in the market place. That’s bullish for safe-haven gold, and to a lesser degree bullish for silver. The rising tensions between Israel and the West, and Iran, are and likely will remain a major bullish fundamental factor for the gold market.

The Mid-East tensions have pushed the European Union sovereign debt crisis to the back burner this week, but for how long, many wonder. The Euro currency pushed to a fresh multi-week high overnight amid ideas the EU debt crisis has stabilized.

The U.S. dollar index is lower again Friday morning as the greenback bears have gained fresh downside technical momentum this week. The dollar index is poised to produce a technically bearish weekly low close on Friday. Meantime, Nymex crude oil futures prices are trading slightly higher after hitting a 9.5-month high on Thursday. The recent rally in crude oil prices is a major bullish factor for the precious metals. Crude oil and the U.S. dollar index will remain the two key “outside markets” that will generally have at least some daily influence on gold and silver price moves.

U.S. economic data due for release Friday includes the University of Michigan consumer sentiment survey and new residential home sales.

The London A.M. gold fixing was $1,778.50 versus the previous London P.M. fixing of $1,777.00.

Technically, April gold futures bulls have gained solid upside near-term technical momentum this week by pushing prices to a three-month high. Gold bulls still have the solid overall near-term technical advantage. Bulls' next upside technical breakout objective is to produce a close above solid technical resistance at the November high of $1,808.00. Bears' next near-term downside price objective is closing prices below solid technical support at the February low of $1,706.70. First resistance is seen at the overnight high of $1,784.40 and then at this week’s high of $1,789.50. First support is seen at $1,765.90 and then at Wednesday’s low of $1,750.70.

March silver futures hit a fresh five-month high overnight before backing off a bit. Silver bulls still have the overall near-term technical advantage and have gained fresh upside momentum this week. Prices are in a seven-week-old uptrend on the daily bar chart. Bulls’ next upside price breakout objective is closing prices above solid technical resistance at $37.50 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at the February low of $32.64. First resistance is seen at the overnight high of $35.72 and then at $36.00. Next support is seen at $35.00 and then at $34.52.

The precious metals markets have had a very good week and profit-taking pullbacks heading into the weekend are not surprising, nor are they unhealthy from a technical perspective, given the recent solid price gains.

Gold and silver have seen stronger demand this week from the present stare-down between allies Israel and the U.S, and Iran. Increasing focus in the media on the potential for Israel or U.S. military action against Iran has prompted increase investor anxiety in the market place. That’s bullish for safe-haven gold, and to a lesser degree bullish for silver. The rising tensions between Israel and the West, and Iran, are and likely will remain a major bullish fundamental factor for the gold market.

The Mid-East tensions have pushed the European Union sovereign debt crisis to the back burner this week, but for how long, many wonder. The Euro currency pushed to a fresh multi-week high overnight amid ideas the EU debt crisis has stabilized.

The U.S. dollar index is lower again Friday morning as the greenback bears have gained fresh downside technical momentum this week. The dollar index is poised to produce a technically bearish weekly low close on Friday. Meantime, Nymex crude oil futures prices are trading slightly higher after hitting a 9.5-month high on Thursday. The recent rally in crude oil prices is a major bullish factor for the precious metals. Crude oil and the U.S. dollar index will remain the two key “outside markets” that will generally have at least some daily influence on gold and silver price moves.

U.S. economic data due for release Friday includes the University of Michigan consumer sentiment survey and new residential home sales.

The London A.M. gold fixing was $1,778.50 versus the previous London P.M. fixing of $1,777.00.

Technically, April gold futures bulls have gained solid upside near-term technical momentum this week by pushing prices to a three-month high. Gold bulls still have the solid overall near-term technical advantage. Bulls' next upside technical breakout objective is to produce a close above solid technical resistance at the November high of $1,808.00. Bears' next near-term downside price objective is closing prices below solid technical support at the February low of $1,706.70. First resistance is seen at the overnight high of $1,784.40 and then at this week’s high of $1,789.50. First support is seen at $1,765.90 and then at Wednesday’s low of $1,750.70.

March silver futures hit a fresh five-month high overnight before backing off a bit. Silver bulls still have the overall near-term technical advantage and have gained fresh upside momentum this week. Prices are in a seven-week-old uptrend on the daily bar chart. Bulls’ next upside price breakout objective is closing prices above solid technical resistance at $37.50 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at the February low of $32.64. First resistance is seen at the overnight high of $35.72 and then at $36.00. Next support is seen at $35.00 and then at $34.52.

Positive German economic data lead to boom in the EUR

The euro again yesterday to make up some of its recent losses, as positive German economic data ensured that investors in European trade in riskier assets turned. The EUR / USD pair rose to 1.3340, before the afternoon was a downward correction. Today, the data should provide the U.S. sales of new buildings to house weekly closing down for volatility. An increase in home sales is expected to lead to gains in the USD to other safe-haven currencies.

USD - claims for unemployment benefits point to continued growth in the U.S. labor market

The U.S. dollar posted slight gains yesterday on several of its major currency rivals, as the positive data on unemployment benefit claims to continued growth in the U.S. labor market hindeuteten. Although the notification of the data, the USD / JPY as well as the USD / CAD pair recorded upward movement, led earlier in the day positive economic data from the euro zone to the fact that the dollar against the euro and British pound sterling experienced a downturn. The EUR / USD pair was the biggest part of the day at or above the value of 1.3300 while the GBP / USD pair recovered from the declining trend of the previous day and increased up to 1.5730.

End of the week, traders should pay attention to the data sent to the U.S. sales of domestic buildings, which are published at 15:00 GMT clock. In addition to the labor market statistics of the real estate market is considered one of the priority indicators for the economic health of the U.S.. Increases in the previous month's data are likely to lead to the USD may record its major currency rivals an increase. That being said, could positive notices from the euro zone cause investors to turn to back riskier assets, which could lead to a decline in the dollar.

A short outlook for the coming week shows that traders with announcements of a number of important U.S. economic indicators can be expected. Particular attention should be paid on Tuesday the report on consumer confidence and apply on Wednesday the preliminary gross domestic product. If even one of the indicators are above expectations, the dollar is likely recorded corresponding gains.

EUR - The EUR could not hold the gains of yesterday's trading permanently

A better than expected German Ifo business climate index has led to the start of yesterday's trading to a brief rise of the euro. The EUR / USD pair was increased compared to the previous evening by over 100 pips and rose to 1.3340. Apart from this, led to concerns that the euro zone could fall again this year into a recession, means that the single currency had to leave a day later from earlier gains. The EUR / USD pair traded most of the day below the level of 1.3300, while EUR / CHF pair during European trading down to 1.2044 sank.

Today, the movements of the EUR should likely be determined by notices from the euro zone. Negative news regarding the economic recovery in the euro zone could cause investors to turn away from riskier assets. Consequently, the euro could increase its declining trend. On the other hand, the data should be the U.S. Home Sales on the expected 316 000 new buildings, the euro could benefit from an upswing and recorded against the USD.

JPY - The yen recorded short-term boost to the USD

The Japanese yen saw gains against the USD short-term, after he had fallen the day before on a 7-month low. The downward movement of the USD / JPY pair was profit-taking on the part attributed to investors who saw the pair as overbought. According to most analysts expected a long-term upward trend of this pair will be possible only if the United States increased its key interest rate. The USD / JPY pair fell in European trading up to 80.03 before settling back to the recovered value of 80.25.

End of the week should Yen traders pay attention to the data sent to the U.S. sales of domestic buildings, which are published at 15:00 GMT clock. Analysts predict that the data are higher than those of the previous month. If this is true, should the USD recorded further gains against the yen. However, should the number be less than the expected 316 000, the yen could make up some of its losses.

Crude Oil - Crude oil inventories rise in U.S. crude oil prices led to a decline in

Crude oil prices fell yesterday for the first time in six days, as hinted at an increase of U.S. crude oil inventories to a decline in demand. However, the crude oil price falls below the value of $ 106 per barrel fell, he was given the ongoing tensions between Iran and the West is still relatively high. The raw materials fell in European trading to $ 105.60 per barrel on.

Today the price of crude oil is expected to be re-determined to a large extent by the conflict with Iran. Evidence that Iran will limit oil exports are likely to continue to push the price of crude oil up before the markets close for the weekend. If, however, be released from the Euro zone negative statements about the economic recovery, this could cause a downturn in crude oil prices.

USD - claims for unemployment benefits point to continued growth in the U.S. labor market

The U.S. dollar posted slight gains yesterday on several of its major currency rivals, as the positive data on unemployment benefit claims to continued growth in the U.S. labor market hindeuteten. Although the notification of the data, the USD / JPY as well as the USD / CAD pair recorded upward movement, led earlier in the day positive economic data from the euro zone to the fact that the dollar against the euro and British pound sterling experienced a downturn. The EUR / USD pair was the biggest part of the day at or above the value of 1.3300 while the GBP / USD pair recovered from the declining trend of the previous day and increased up to 1.5730.

End of the week, traders should pay attention to the data sent to the U.S. sales of domestic buildings, which are published at 15:00 GMT clock. In addition to the labor market statistics of the real estate market is considered one of the priority indicators for the economic health of the U.S.. Increases in the previous month's data are likely to lead to the USD may record its major currency rivals an increase. That being said, could positive notices from the euro zone cause investors to turn to back riskier assets, which could lead to a decline in the dollar.

A short outlook for the coming week shows that traders with announcements of a number of important U.S. economic indicators can be expected. Particular attention should be paid on Tuesday the report on consumer confidence and apply on Wednesday the preliminary gross domestic product. If even one of the indicators are above expectations, the dollar is likely recorded corresponding gains.

EUR - The EUR could not hold the gains of yesterday's trading permanently

A better than expected German Ifo business climate index has led to the start of yesterday's trading to a brief rise of the euro. The EUR / USD pair was increased compared to the previous evening by over 100 pips and rose to 1.3340. Apart from this, led to concerns that the euro zone could fall again this year into a recession, means that the single currency had to leave a day later from earlier gains. The EUR / USD pair traded most of the day below the level of 1.3300, while EUR / CHF pair during European trading down to 1.2044 sank.

Today, the movements of the EUR should likely be determined by notices from the euro zone. Negative news regarding the economic recovery in the euro zone could cause investors to turn away from riskier assets. Consequently, the euro could increase its declining trend. On the other hand, the data should be the U.S. Home Sales on the expected 316 000 new buildings, the euro could benefit from an upswing and recorded against the USD.

JPY - The yen recorded short-term boost to the USD

The Japanese yen saw gains against the USD short-term, after he had fallen the day before on a 7-month low. The downward movement of the USD / JPY pair was profit-taking on the part attributed to investors who saw the pair as overbought. According to most analysts expected a long-term upward trend of this pair will be possible only if the United States increased its key interest rate. The USD / JPY pair fell in European trading up to 80.03 before settling back to the recovered value of 80.25.

End of the week should Yen traders pay attention to the data sent to the U.S. sales of domestic buildings, which are published at 15:00 GMT clock. Analysts predict that the data are higher than those of the previous month. If this is true, should the USD recorded further gains against the yen. However, should the number be less than the expected 316 000, the yen could make up some of its losses.

Crude Oil - Crude oil inventories rise in U.S. crude oil prices led to a decline in

Crude oil prices fell yesterday for the first time in six days, as hinted at an increase of U.S. crude oil inventories to a decline in demand. However, the crude oil price falls below the value of $ 106 per barrel fell, he was given the ongoing tensions between Iran and the West is still relatively high. The raw materials fell in European trading to $ 105.60 per barrel on.

Today the price of crude oil is expected to be re-determined to a large extent by the conflict with Iran. Evidence that Iran will limit oil exports are likely to continue to push the price of crude oil up before the markets close for the weekend. If, however, be released from the Euro zone negative statements about the economic recovery, this could cause a downturn in crude oil prices.

Analysis Silver - 24 Feb 1355

SILVER (Spot) intraday: up turn.

Update on supports and resistances. ( 24/02/2012 13:55 )

Pivot: 35.05

Our Preference: LONG positions above 35.05 with 35.6 & 36.25 as next targets.